Financial Insecurity During Unprecedented Times of Crisis

The economic collapse of COVID-19 and the widespread recognition of racial injustice are shining a light on long-standing issues within our financial system--issues that many people in America acknowledged long before these events.

Real-time Research with Financially Vulnerable People

To respond to this rapidly-changing environment, Commonwealth has shifted our research process and partnership approach to provide near real-time insights that can quickly shape action by employers, financial services firms, fintechs and more.

This intensely collaborative process is now characterized by a continuous cycle of pause - listen/learn - react. Together, we are leveraging traditional interview methods, and leading AI and other technologies, to rapidly conduct quantitative and qualitative research with financially vulnerable people. The below insights are designed to spark ideas and action to drive systemic change and enable financial security.

Our research is focused on three broad areas:

- Emergency Savings - Short-term, liquid savings to manage unexpected expenses and income volatility.

- Wealth Building - Long-term prosperity and asset building to close the wealth gap.

- Organizational Shift - Business and policy leaders make financial security a priority to change systems.

Emergency Savings

Short-term, liquid savings to manage unexpected expenses and income volatility.

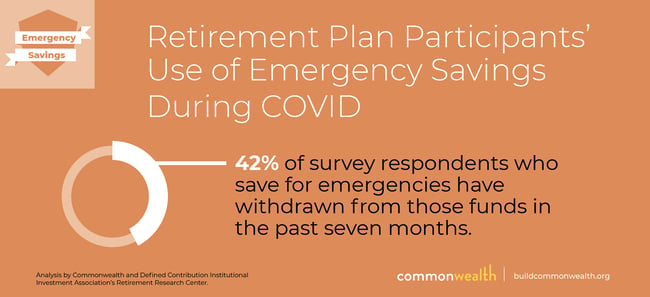

Our latest survey, in partnership with the Defined Contribution Institutional Investment Association’s Retirement Research Center, found that low- to moderate-income retirement plan participants are continuing to use emergency savings (if they have them) rather than tap their retirement savings during the pandemic.

Read our latest “Saving Through a Crisis” blog to learn what this finding may mean for plan participants’ financial security, as well as our other top insights from this recent round of research.

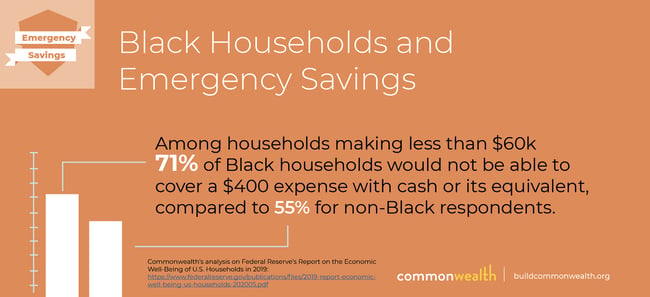

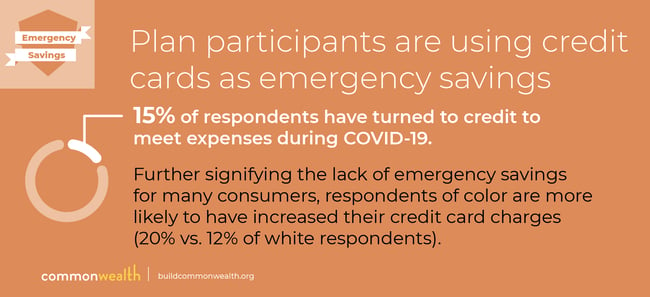

The Federal Reserve's statistic stating that 37% of Americans would not be able to cover a $400 emergency expense with cash or its equivalent has become ubiquitous in the mainstream media. We decided to dig deeper to see how this applies to households making under $60k, and for Black people and women: the statistics are even more concerning for these populations, even pre-COVID.

The Federal Reserve's statistic stating that 37% of Americans would not be able to cover a $400 emergency expense with cash or its equivalent has become ubiquitous in the mainstream media. We decided to dig deeper to see how this applies to households making under $60k, and for Black people and women: the statistics are even more concerning for these populations, even pre-COVID.

The 2019 data was, at first, encouraging: it showed a slight improvement across all demographics, down from 40% in 2018. But when we dug deeper, it became clear that the emergency savings crisis is still dire for many Americans.

In the months since the outbreak of COVID-19, the pandemic has continued to expose and exacerbate cracks in people’s financial lives. In our latest research, Commonwealth partnered with the Defined Contribution Institutional Investment Association’s (DCIIA) Retirement Research Center on a series of surveys to better understand how low- to moderate-income (“LMI”) plan participants are handling their retirement savings during the pandemic and the impact to their financial security.

Read our blog for four key findings from our first survey in this series.

Wealth Building

Long-term prosperity and asset building to close the wealth gap.

In early 2020, Commonwealth interviewed 14 people between ages 25 and 40 making <$60K in annual household income to examine whether credit building is a viable pathway to wealth building.

People tend to think about the impact that credit can have on interest rates for credit cards and loans, but this quote shows that credit influences many other aspects of people’s financial lives, in some cases affecting what jobs they qualify for. Credit building is a key part of someone’s wealth building journey, and products and services that aim to help people build credit scores should highlight the connection between credit and financial opportunity.

Organizational Shift

Business and policy leaders make financial security a priority to change systems.

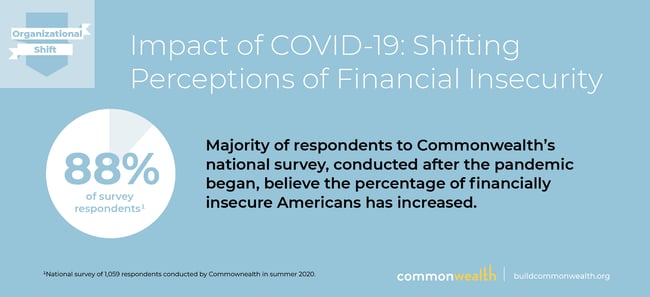

According to a national Commonwealth survey conducted after the pandemic began, a majority of respondents believe the percentage of financially insecure Americans has increased since the start of the pandemic (88% of 1,059 respondents).

Respondents believe that, on average, 63% of Americans have become financially insecure since February 1, 2020; respondents also believed that only 44% of Americans were financially insecure prior to February 1, 2020. Meanwhile, respondents to Commonwealth’s 2019 national perception survey—conducted in the relative calm of summer 2019—believed that 53% of Americans were financially insecure.

In our recent consumer interviews, people have expressed a desire to support those they know. There is also more willingness to accept assistance than usual; overall, those with family or community support reported feeling less affected or stressed by the financial crisis.

In our recent consumer interviews, people have expressed a desire to support those they know. There is also more willingness to accept assistance than usual; overall, those with family or community support reported feeling less affected or stressed by the financial crisis.

Some ways to spark action include: 1) employers can create opportunities for employees to support each other, monetarily or through donated services; 2) financial institutions can make it quicker to send money, and remove associated fees; and 3) credit card companies can make it simpler to share cash back rewards with others.